DeFi, or decentralized finance, has become a huge industry in such a short span of time. While many thought of it to be just a buzzword initially, it’s growing at an unprecedented space. And perhaps that’s why we are seeing the influx of new companies in the space. In this piece, we’d be talking about one such company that seems to be solving an important problem in an innovative manner. Shield Finance, as the name indicates, aims to shield your money from malicious practices. Wondering why this project is worth paying attention to? Read on to find out.

Related read: Top 5 DeFi projects to watch out for

Overview

Shield Finance highlights itself as a “multi-chain DeFi insurance aggregator“. Now, to understand that, we need to separate the phrase.

Multi-chain refers to the fact that the project supports multiple chains. These include Polkadot, Binance Smart Chain, Ethereum, and Solana. You could notice that each of these blockchain networks are quite big in their own right, with Ethereum being the second biggest virtual currency.

DeFi insurance indicates that you could insure your currency from unforeseen circumstances. Like any insurance, in case something goes wrong, you’d be liable to get some or all of your money as part of the insurance.

While all this may not sound amazing, Shield Finance goes a step further by aggregating various insurance providers.

Team

The team behind Shield Finance has some capable names:

Denis Gorbachev – CEO / CTO

Denis started programming at the young age of 14 and has built over 30 projects. These projects have been built using various programming languages such as C++, Python, Javascript, and Solidity. He also worked as a CTO at a YCombinator-backed company. In terms of experience in the crypto space, he built Moonbase Exchange that offered the ability to have perpetual swaps.

Alexey Serdiuchenko – UX / UI

Alexey is named as the top-rated designers on Upwork and has worked with brands like Qatar Airways and Volvo. He has participated in multiple crypto projects and has invested in hundreds of them as well.

Backers and advisors

Shield Finance is backed by some notable names in the crypto space:

Master Ventures

With names like Coinbase and Kraken in its portfolio, Master Ventures has backed a number of significant startups in the world of blockchain and cryptocurrencies. It also works as a Marketing Partner for Shield Finance.

XBC

This one also works with the project as a Marketing Partner since it’s an integrated social marketing agency. It’s working with projects like Polkastarter, ACDX, and more.

Other backers inclue NGC, A195 Capital, and GD10 Ventures.

The project also has advisors like

- Dr Deeban Ratneswaran: Chief Executive Officer, GD10 Ventures

- Dane Hoy: Managing Partner, Master Ventures

- Kyle Chasse: Chief Executive Officer, Master Ventures

- Roderick McKinley: CFA Independent Advisor

Tokenomics

As with a lot of crypto projects, Shield Finance has a burn program to ensure that the value of its tokens continues to increase. Dubbed as the buy and burn program, it means that 50% of the fees are used to buy the token on the public market and then burning it. Hence, these $SHLD tokens are removed from circulation forever.

The token holders also have the governance powers, such as the ability to change the fee structure, and add new insurance providers, among other things.

That’s not it, the token holders would also get staking benefits. The $SHLD token holders with getting 30% APY (Annual Percentage Yield).

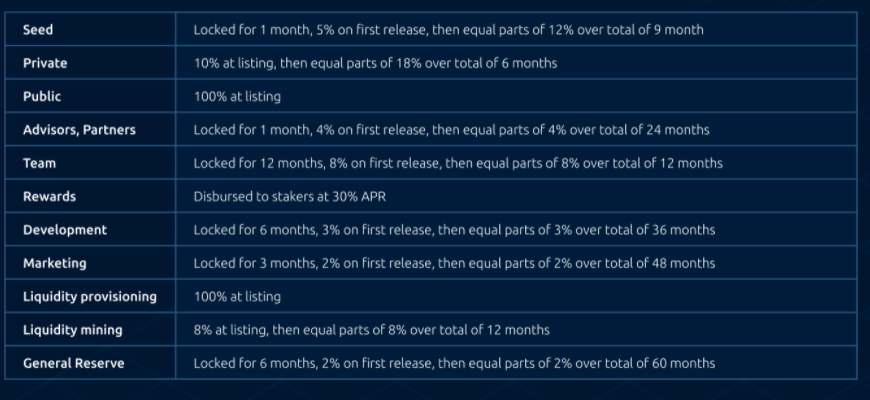

Token vesting schedule

Mentioned below is the vesting schedule for the various sets of token holders.

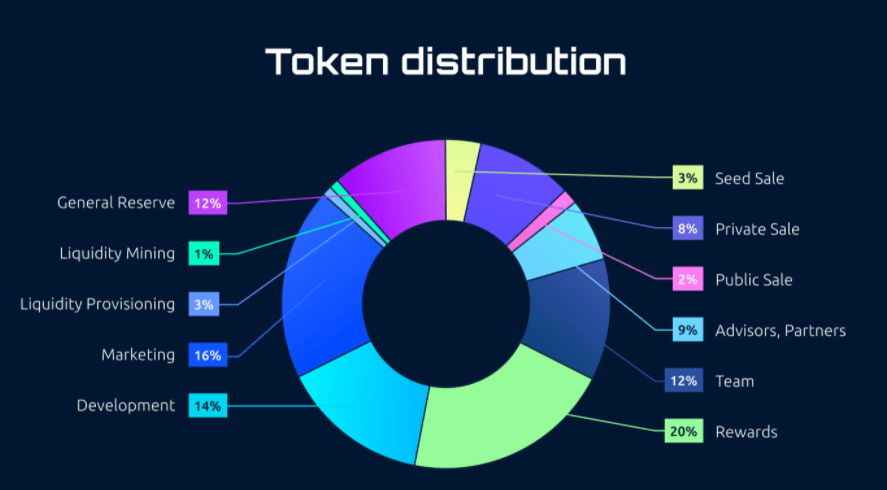

The chart below suggests the equitable token distribution among various stakeholders.

Use case

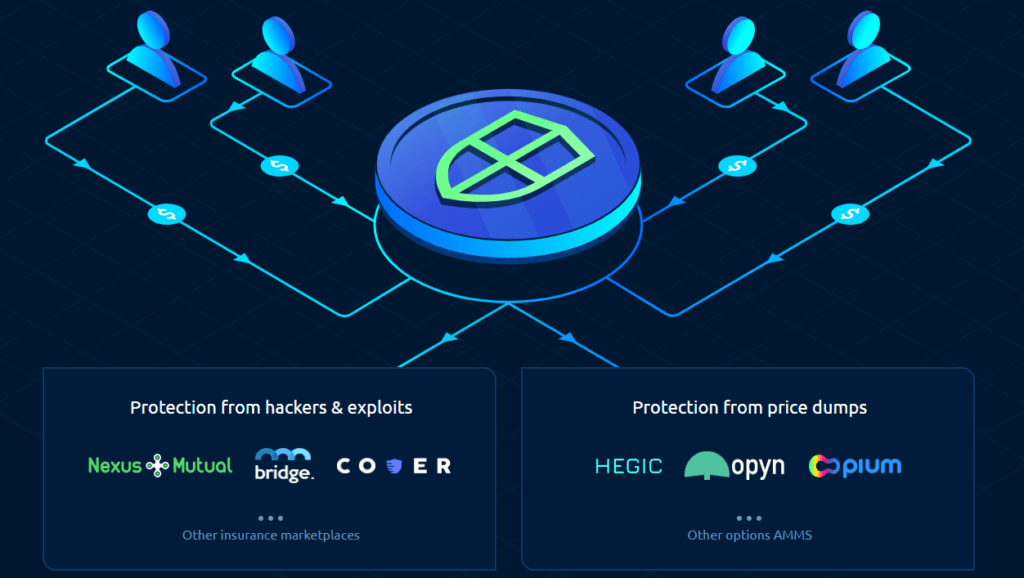

As mentioned in the overview, Shield Finance protects you against any chances of losing your money. So the biggest benefit of $SHLD tokens is that you would be protected against scenarios such as hacks, exploits, and sell-offs which cause instability in the market.

For each of these scenarios, Shield Finance works with different insurance providers. For protection from hackers and exploits, it has partnered with Nexus Mutual, Bridge, and Cover. While for protection from price dumps, the project has partnered with Hegic, Opun, and Oopium. The user can set what kind of protection they are looking for and Shield Finance would suggest insurance providers accordingly.

Ecosystem

One thing that sets Shield Finance from other projects is its vast ecosystem. As mentioned above, it works with multiple blockchains.

With the blockchain ecosystem growing so rapidly, getting hacked or any market manipulation isn’t unlikely. So the marketplace model of Shield Finance is quite interesting. A user can opt for the insurance provider as per their needs.

Roadmap

The team has an aggressive plan for the project. In the first quarter of 2021, it had received feedback from developers and users. It has also hired its employees along with closing funding rounds.

In this quarter, the project would be launching a testnet. More importantly, it’ll conduct a token generating event along with announcing a public sale. The project will also integrate with insurance providers like Nexus Mutual and Cover Protocol.

In the next two quarters, Shield Finance would be launching its mainnet, conduct a security audit, and integrate with Binance Smart Chain and Polkadot insurance providers.

Conclusion

Only the market response will tell whether this project will succeed or not. But one thing is for sure that it’s aiming to solve a problem that will continue to become bigger. Moreover, with a well-thought-out tokenomics and vesting schedule along with things like buy and burn program, the project aims to provide value to $SHLD holders too.

What do you think about this project? Let us know in the comment box below.

To Know moke about Shield Finance Click here