What are Unicorns? Who are the new Crypto-corns in the market? Here’s all you need to know. The rapid exponential growth of cryptocurrencies has opened a bay of opportunities for idealists across the globe. Since the year began, more than 50 cryptocurrency and blockchain-related projects have risen to the much-coveted unicorn status, with market analysts predicting more to come. A unicorn is a company that has been valued at more than one billion dollars by venture capitalists.

The term was first popularised in 2013 by venture capitalist Aileen Lee, choosing the mythical animal to represent the statistical rarity of such successful ventures. And that is a critical perspective to keep in mind. The rarity of such ventures was so high that it was believed to be very tough for companies to earn this status. And being a Cryptocurrency startup is hard enough, but success is even harder. Keeping that in the back of our minds, let’s move on and see what stats await us. And have a look at the top 5 Unicorns in the Crypto space.

Bakkt

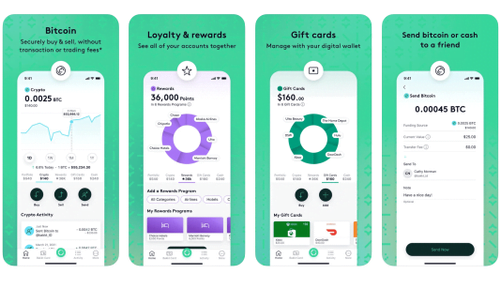

Bakkt is a trusted way to bring together market leaders, including an enterprise software company and consumer companies, an independent software vendor, and financial technology companies.

After going public via a merger with VPC Impact Acquisition Holdings in January 2021, Bakkt’s valuation was set at $2.1 billion. The money raised by Bakkt is expected to finance the company’s move toward a focus on consumer applications for digital assets. According to reports, more than 400,000 customers had pre-registered for the Bakkt app as the platform supports more than 30 loyalty programs.

The company offers crypto trading and payments features with a fully regulated Bitcoin derivatives futures and options market.

Binance

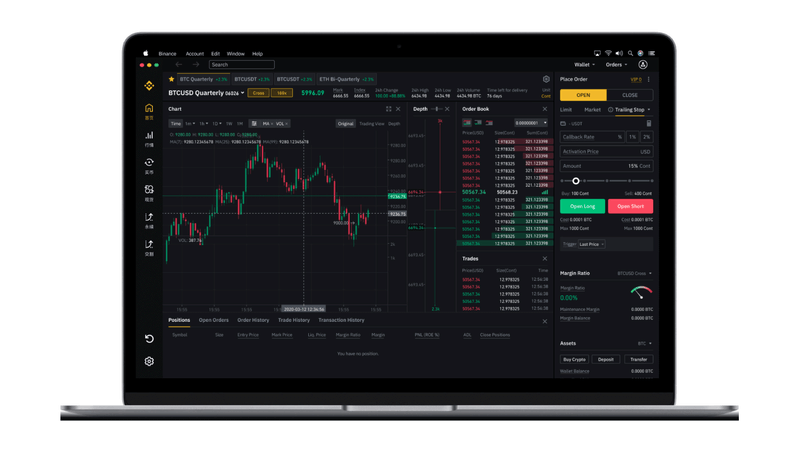

The Binance blockchain ecosystem for cryptocurrencies exchange offers trading with the most popular digital coins on the market.

In less than 5 months, they’ve become the world’s 3rd biggest cryptocurrency exchange (though, according to Binance founder/CEO Changpeng Zhao aka CP, they are now #2, just behind Bitfinex, for now). Binance is valued at not just $1bn+ but closer to $2bn+, and they did it in less than 6 months. Yes, you read it right, 6 months.

Binance is a simple to use, safe crypto-currency exchange, helping investors and traders buy/sell while taking a commission.

Blockchain.com

Blockchain.com is the premier digital asset platform, the foundational technology behind cryptocurrencies like bitcoin and ether.

Formerly known as Blockchain.info, Blockchain.com is a widely popular crypto wallet and exchange that has grown significantly since its early inception back in 2011. Boasting over $800 billion in crypto transactions to date, Blockchain.com raised $120 million in a funding round, bringing the platform’s value over $1 billion.

Soon after raising $120 million, Blockchain.com raised another $300 million in March, setting its value at a whopping $5.2 billion. This was part of the company’s Series C round that saw the participation of venture capital firms such as DST Global, VY Capital, and Lightspeed Venture Partners.

- Valuation:$5.20B (February 2021)

- Country: United Kingdom

- Funding Amount: $490,000,000

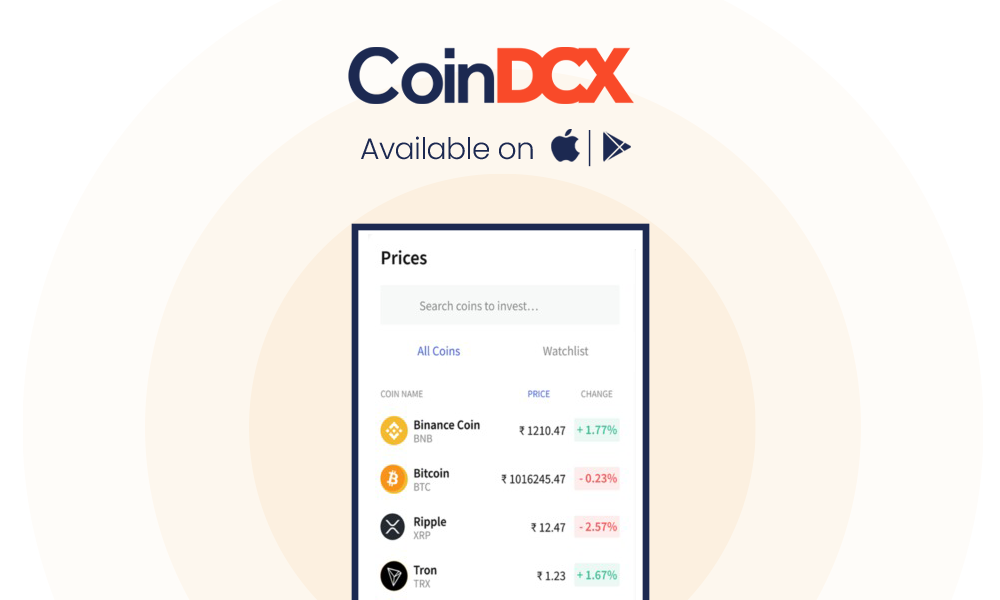

CoinDCX

Recently, the Indian crypto exchange CoinDCX announced that it has raised $90 million in a Series C funding round.

The Mumbai-based startup will go down in history as India’s first crypto business to reach unicorn status following the investment round led by B Capital Ground and the participation of Block.one, Polychain, Jump Capital, and Coinbase Ventures. So far, CoinDCX has gathered more than 3.5 million users with intentions of using the funds from its latest fundraising to speed up the user onboarding process up to 50 million users in India.

Ripple

Ripple offers blockchain solutions to transfer money globally with speed and certainty of settlement.

With its $10 billion valuation, San Francisco-based Ripple raised $200 million in a Series C funding round. That same year, the company purchased a $50 million stake in the remittance platform MoneyGram.

Why now?

As venture capital firms continue to flood the crypto and digital asset space with more money, a stampede of unicorns is emerging, unlike anything the space has ever witnessed. There is no hot trend or complicated explanation for why crypto is having its moment right now, say those in the industry. Rather, it is the maturation of the industry and everything that goes along with that evolution that is making companies hit the magical unicorn mark.

Also Read: