Duet is the world’s first multiple-chain digital asset protocol with a hybrid mechanism. Basically, it ‘sharpens’ all the assets traded on the blockchain. As the name implies to a piece of music where two individuals play different melodies, the Duet protocol allows traders to replicate real-world tradeable assets in a DeFi ecosystem. In addition, this protocol proposed a dual-channel pegging mechanism for digital assets. It also gave birth to two new systems: Lite Mint and Zerogoki.

Through this, users on the protocol can burn DUET and mint equal dollar value digital assets. It benefits minting users through a more convenient minting method, higher capital utilization efficiency, and easier arbitrage opportunities.

However, Lite Mint strongly incentivizes synthetic assets minter & benefits early synthetic assets. This created a systemic risk as DUET circulation is an elastic supply in the short term.

Duet protocol has Zerogoki: a synthetic asset platform that takes algorithm anchoring mechanism into real transaction scenarios to improve the validation of Duet design and perfect the risk control mechanism.

Overview

Zerogoki is a leveraged token trading platform that is deployed on the Ethereum blockchain. The platform is based on an algorithmic pegging mechanism. This provides users with leverage tools for traditional assets such as foreign exchange, gold, and bonds. Moreover, users can use the platform token REI to cast leverage tokens or use the protocol’s synthetic dollar-zUSD to buy leverage assets directly.

This token trading platform is a pilot project from the Duet protocol that only contains the Lite-minting module. What that means is, synthetic assets are generated after the destruction of the protocol asset-REI. On the other hand, volatile leverage tokens are chosen as listed assets. This is to increase the system test pressure.

What is the difference between Duet and Zerogoki?

While Zerogoki is an experimental project, Duet Protocol has a more robust risk control concept. Zerogoki takes on a certain level of pressure test task, unlike Duet. Since the mechanism design is different, Zerogoki has a different risk & income structure than the Duet protocol. Moreover, users need to understand the mechanism of the protocol in Zerogoki.

Other than this, there are some more differences:

- Zerogoki only supports algorithm mint/redeem, unlike Duet which supports dual-channel synthetic asset minting. What this means is, it requires the burning of REI to determine the source of value. Moreover, there are not excess collateral assets in the Zerogoki system due to lack of CDP concept.

- Zerogoki supports the minting and trading of financial assets including cryptocurrency, commodities, forex, bonds, stocks, and financial index. The platform also presents leveraged tokens to put more pressure on the system. General price principle of leveraged tokens refers to FTX leveraged tokens.

- Zerogoki is a community-oriented project where liquidity providers bear higher risks. Moreover, the allocation of tokens is more focused on incentivizing liquidity providers. As a result, the reward is an allocation of 50% of the REI tokens. On the other hand, in Duet ecosystem, only 10% of REI is kept as a reward for governance participants.

Internal Assets of Zerogoki: REI and zAsset

Zerogoki produces two types of assets, the system token REI, and the synthetic asset zAsset. Zerogoki Oracle determines the conversion rate for the minting procedure. This does not follow price fluctuations in the on-chain swap market. Moreover, it will follow the price calculated from off-chain prices. Here, the assets have better liquidity.

Protocol token of Zerogoki: REI

Zerogoki’s core asset is its native token: REI. REI is fuel for synthetic leveraged assets. $1 of synthetic assets minted equivalent to the burning of $1 REI. Moreover, Synthetic assets and REI are two-way interoperable. In the long run, with the growth of synthetic assets supplies’, REI will deflate and the actual total amount of tokens will gradually decrease.

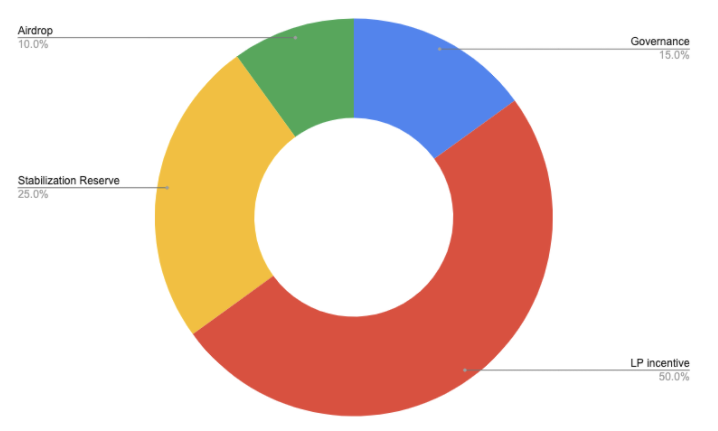

The initial circulation of REI is 42 million tokens. The token distribution chart is as follows:

- Liquidity incentive(50%) – Incentive liquidity providers of Zerogoki internal assets.

- Governance Incentive(15%) – Reward participants of Zerogoki governance and voting.

- Airdrop(10%) – Reward Duet early community contributor, eco partners and future activities.

- Community Reserve(25%) – For systematic risk control.

The overall emission rate of REI increases along with the growth of zAsset. As a result, the overall release cycle of liquidity incentives compresses to 1 year compared to 6 years in Duet. After a while, when the REI token reward is lower but transaction volume is higher, users‘ incentive for providing liquidity will rely on transaction fees from the swap pool, active market-making to obtain arbitrage income or participation in new developments in the system. This will also create profits for users.

Functions of REI

The basic functions of REI are system fees, minting synthetic assets, governance, and Duet ecosystem participation certificates. However, there are some more functions of REI:

- REI is the main asset in the system and source of synthetic assets. Users will burn REI in Lite Mint and issue zAsset. WHen more synthetic assets are minted, more REI is burned. So overall, the amount of REI decreases due to the abundance of variety and quantity.

- A small amount of trading fee is charged for each Zerogoki’s mint or redeem. It is equivalent to a certain percentage of burned assets. The fee is similar to “minting tax” which the platform uses for earning. Basically, projects may choose to burn the collected fee, and the DAO will determine the use after the governance module goes live.

- REI also functions as the governance certificate of the Zerogoki. Users stake REI in governance module to participate in voting. The founding team decides the basic parameters and supporting assets of the current agreement. Moreover, the DAO can decide any adjustments in the future regarding the parameters. Users can decide synthetic asset listing/delisting, the calculation method, and proportion of mint taxation, the emission speed of liquidity incentives and the distribution of each pool, the use of project reserves etc.

- Since Zerogoki is the first product offically launched in the Duet ecosystem, Duet will regard Zerogoki as early participants and supporters of the ecosystem. It will also serve as a medal for early participants and reap rewards of the project in the expansion of Duet ecosystem in the future.

Leveraged Token: zAssetX

While REI has governance rights & is the fuel for minting synthetic assets, zAsset includes stablecoin zUSD and other leveraged tokens.

Zerogoki plans to support the following leverage tokens for minting and trading. It covers crypto assets and six broad categories for traditional assets: stocks, commodities, bonds, financial indices, and foreign exchange. These are:

Mintable Assets:

- zBTC 3L/3S

- zETH 3L/3S

- zUST 20L/S US 10-year Treasury Bonds

- zMVI 2L/S Metaverse Index

Synthetic assets coming online:

- zVIX 3L volatility index

- zXAUUSD 3L Gold Commodity Price

- zEURUSD 20L Euro/US Dollar

- zNDX 10L Nasdaq 100 Index

Final Thoughts

Since the Duet protocol already tackles incentivization of synthetic assets, it needed to validate the preliminary design and improve the risk control mechanism. And this is where Zerogoki comes in.

This experimental project provides users with the necessary tools for leveraging traditional assets such as foreign exchange, gold, and bonds. Moreover, users can use the platform token REI to cast leverage tokens or use the protocol’s synthetic dollar-zUSD to buy leverage assets directly. Although the project has a higher risk category than the Duet protocol, it serves as a befitting idea of how platforms in the future can leverage synthetic tokens in incorporating traditional trading instruments.

Related Stories: