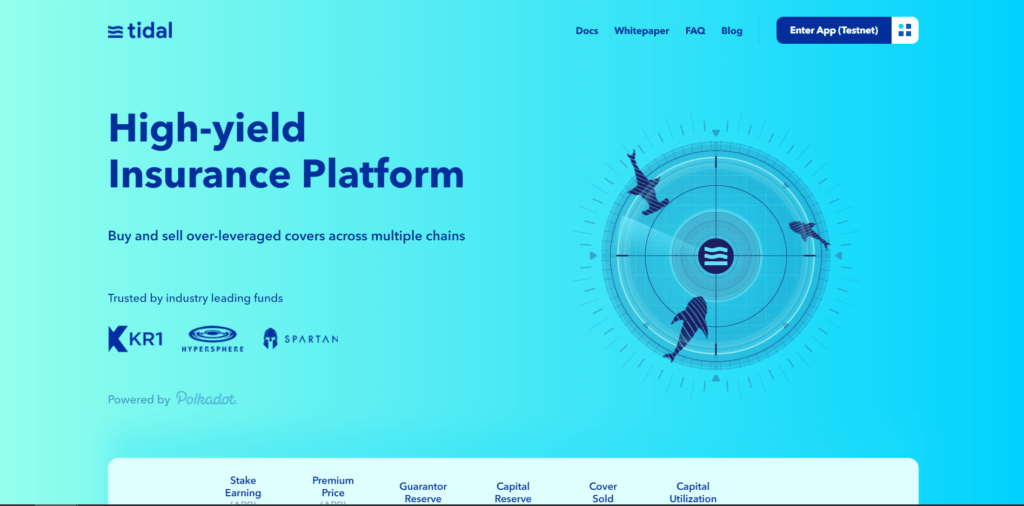

Tidal finance is a high-yield insurance platform to buy/sell over-leveraged cover across a wide suite of chains. The company has announced a testnet program with a reward pool of $10,000 for engaging in buying/selling coverage.

Alongside a testnet program, Tidal finance has also partnered with a couple of top-tier foundations like Oasis, Polygon, and Elrond. The company has also partnered up with multiple DeFi protocols that may require insurance in the coming months (Injective, Hopr, Xend, etcetera).

On this announcement, co-founder Chad Liu said:

“The demand for insurance coverage has been increasing daily, with the total value locked reaching $60 billion. Tidal is bringing an innovative solution to this space, and we are glad to see other protocol teams and ecosystem partners supporting this initiative.”

He also added that the testnet launch is an important step to provide a high-quality product to the market.

The testing period will run for 20 days with 10 intervals on Ethereum Ropsten using testnet tokens. Users can buy and sell coverage, deposit/withdraw assets from liquidity pools, and stake governor tokens. A scoreboard will track each user’s activities. This exercise will offer the team data points to test the platform’s robustness and collect feedback for improvements.