With the multitude of tokens available in the “crypto world”, it is becoming a difficult task to choose the token for investing and managing crypto assets is an even bigger task. There is a growing need among crypto investors across the globe to have a platform that can manage all crypto assets under one roof. DeHive protocol aims to solve his problem.

Overview

DeHive protocol is an in-house project developed and maintained by Defi platform developing firm Blaize.tech that allows managing all your crypto-assets under a single protocol.

Basically, the protocol provides crypto indexes of selected tokens presented on the DeFi market. The underlying assets are securely stored in the smart contracts of the protocol and the user has full transparency of balances of his assets.

How does the protocol work?

So if you are wondering, how does the protocol work. It does that in just five steps:

- The user makes an initial contribution in ETH.

- The platform accepts the ETH.

- The in-built oracles checks for the actual prices of the index’s underlying cryptocurrencies.

- Smart contract issues the crypto-index to the user in the amount corresponding to the calculation of the weights of the underlying crypto assets.

- The protocol algorithm redeems the underlying assets and securely stores them on the platform assigned to the user.

Initially, The DeHive index unites multiple top-notch DeFi protocol tokens in one area. They are based on the best DeFi aggregators, liquidity pools and financial market strategies applied by the platform’s DeFi experts and analysts. The platform then implements a mechanism to purchase the underlying crypto assets in order to support the index. The index is backed by a set of crypto assets in an optimal proportion for passive income.

DHV Token

DHV is the native token of the DeHive platform that allows users access to the DeHive ecosystem, issuing DeHive indexes, creating unique indexes, participating in additional protocol features, and partake in protocol governance through DAO mechanisms. In short, the token is needed for:

- Protocol economy support during index redemption

- Depositing along with the index to get yield

- Liquidity mining

- Protocol governance

- Custom index issuing

- Support of protocol treasury

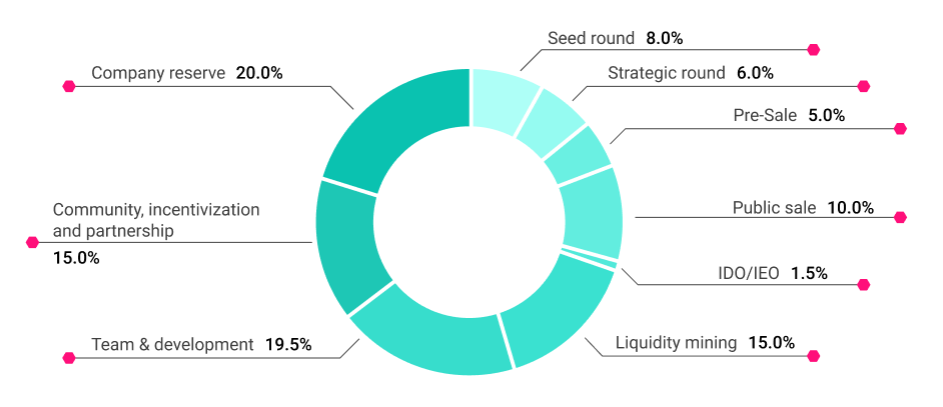

Tokenomics

10 million DHV tokens will be minted for protocol maintenance purposes. The graph mentioned above represents the distribution and circulating supply of the tokens.

Users will be able to get more DHV tokens through staking their existing DHV along with DeHive index or as a reward during protocol integration with other protocols.

Staking

The DeHive protocol offers an efficient strategy for users to stake the token which represents the index and benefit from yield farming opportunities.

In essence, it comprises the following four steps:

- User locks a certain amount of their acquired index tokens along with the DHV token so stake it within the protocol;

- The smart contract using the in-built oracles retrieves the current prices of the underlying crypto-assets;

- Corresponding to the chosen index, the platform sends the underlying currencies separately to the yield farming protocols using the most optimized strategies;

- The converted yield is returned to the user in the form of new index tokens backed by the profit generated.

Protocol Governance

The platform will provide users to take part in protocol governance through DAO implementation.

A major advantage for this is the ability to vote for the next index to be issues and supported by the platform. In this case, DHV token holders will be able to vote and approve the set of underlying assets they believe are needed and economically viable.

DAO participants will also be able to vote for including previously created custom indexes into yield farming strategies. This will include all the benefits provided to the creator and the supporters of that custom index.

Roadmap

The company had its pre-sale on March 24 and as of now will be concentrating on the product’s MVP development. Public sale will start from 14th April till 19th April.

The platform’s launch is expected in July 2021 along with staking and liquidity mining opportunities. The second index is planned for launch in the third quarter of this year.

Expansion and integration to other parachains is expected between the third and fourth quarter of this year. It’ll include DAO development, a new set of native indexes, custom indexes fabric, etcetera.

Proceeding that, the platform will be concentrating on Index issues and integration with the Avalanche chain and Polkadot ecosystem. The initial set up for Binance smart chain is expected in the first quarter of next year.

Final thoughts

All round speaking, DeHive picks upon an interesting concept that could prove to be beneficial for a lot of potential users who want to manage their crypto assets under a single index. Along with the fact that the protocol will soon be integrated to other parachains for a proper cross-chain network will bear fruit to not only itself but to its community which will gradually grow too. Moreover, the concept of managing crypto assets using a single token is a very strong and will see a lot of platforms adopting this idea very soon.

For more details, you can check out their website: https://dehive.finance/

• Twitter: https://twitter.com/dehive_finance

• CoinMarketCap: https://coinmarketcap.com/currencies/dehive

• Telegram Chat: https://t.me/DeHive_chat

• Telegram Announcement Channel: https://t.me/DeHive_ann