While still in its infancy, decentralized Finance (DeFi) is garnering significant attention from many industries around the world. Although some are still sceptical of the workings of DeFi, many see it as the strongest alternative to traditional financial systems. Overall, it is a revolutionary approach to interacting with monetary systems and bringing in changes on virtually every financial instrument. Some examples of such systems include Aave, Compound, and Vee Finance.

However, while DeFi sounds very good, it still has its problems. And a major one is the relatively slow rate of adoption. While the number of DeFi systems is increasing daily, it’s still got a long way to go. This has implications for the general public’s interactions with such systems. While the enthusiastic ones may have a good idea about DeFi systems, the majority don’t even have a clue about it. Moreover, there is a greater need to increase the user adoption rate for DeFi systems. This will, in turn, improve the system and iron out kinks over time.

Fortunately, there are platforms aiming to lower the threshold for traditional financial users to participate in DeFi systems. Today, we’ll talk about Vee Finance and why it looks like the platform has the edge over its competitors.

Overview

Vee Finance is a DeFi lending platform for traditional finance and crypto users based on the Avalanche Network. Users can participate in deposits, loans, long and short positions, and as well as other functions.

The platform wants to encourage users to enter the world of DeFi through a more product-friendly experience, with the addition of a DEX. Overall, it aims to provide the need of both parties in a transaction: suppliers & borrowers.

- Suppliers: Providing them with safe tokens and high returns.

- Borrowers: Convenience and acceptable costs thereby increasing capital efficiency.

Vee Finance Features

Diving into the features, Vee Finance providers both, the suppliers and borrowers with the following features:

- Suppliers

- More token options.

- Support for multiple public chains & cross-chains. Using Token Bridge, the platform enables the movement of tokens across multiple public chains, maximizing their returns.

- Option of a new fixed rate deposit function for traditional financial users.

- Addition of fiat deposit aggregation and Wyre direct fiat support for new crypto users.

- Support for NFT tokens.

- Borrowers

- A unique embedded arbitrage mechanism for lending and trading. Through this, the platform allows for precise profit-taking during the upward cycle of the digital currency market. This ensures the relative stability of returns.

- Vee Finance provides flexible parameter control of the arbitrage mechanism. Also, for entry level users, it provides default configurations based on artificial intelligence and big data recommendations.

- Integrated DEX option, allowing leverage of collateralized borrowings for trading.

Moreover, Vee Finance, with its three offerings: Money Markets, Trade, and Asset Bridges, is aiming to ‘revolutionize’ the way people interact with DeFi.

- Money Markets: A decentralized lending marketplace for lenders and borrowers around the world.

- Trade: Buying/Selling crypto pairs with leverage trading capabilities.

- Asset Bridges: A lending platform with asset bridges across multiple blockchains.

Team and Investors

A total of 25 people heading from various countries head this DeFi lending platform.

- Felix Li: Chief Risk Officer

- He has over 10 years of experience in traditional finance.

- He was the CEO of a Singapore-based crypto exchange, UEX.com.

- Jason Huang: Chief Technology Officer

- He has over 20 years of experience in software development.

- He has also been in the blockchain space for more than 3 years.

- Tejas Shinge: Chief Executive Officer

- He has 9 years of experience in Risk & Marketing Analytics/Modelling.

- He has previously worked with large corporates as a VP for Marketing.

The platform also has the backing of many major investors, including:

- Huobi Ventures Blockchain Fund.

- Avalanche Asia Eco Fund.

- Momentum 6.

- NGC Ventures.

- Dutch Crypto Investors.

- FBG Capital.

Vee Finance Token: VEE

VEE is the native token of Vee Finance. It was developed to achieve full decentralization in the platform. The token is an ERC-20 type that serves as the connector of the Vee Finance protocol.

Moreover, VEE has many applications in the platform:

- Liquidity Mining – Miners contributing capital to the protocol receive a portion of newly minded VEE for their contribution. Also, the number of newly mined VEE follows a profit allocation curve.

- Governance – VEE tokens also represent as token holder’s voting rights. Moreover, each token entitles to one voting right.

Moreover, the framework ensures a prosperous, secure, and healthy community. Also, the community voting includes:

- New tokens supported as collateral.

- Highest leverage on each token.

- Partnerships with new DEXes.

Tokenomics

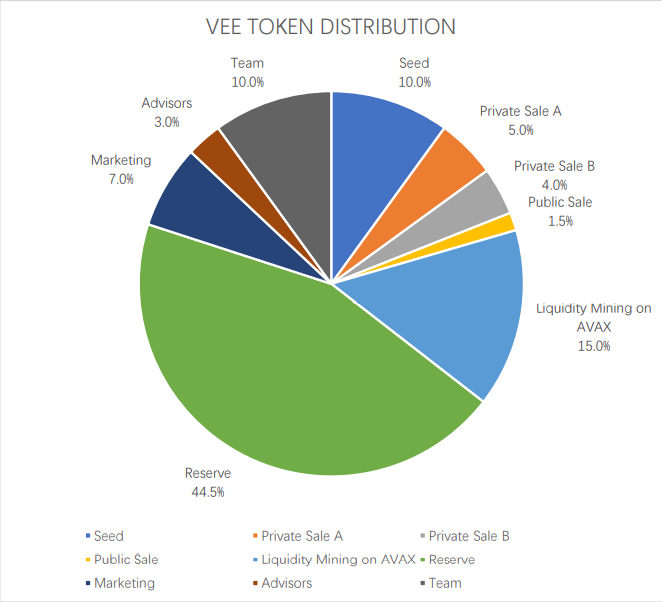

The total supply of VEE tokens is 10 billion tokens. Also, the token distribution chart of VEE is shown below:

The vesting schedule for VEE tokens is mentioned below:

- Seed Sale – lock for 6 months, and then monthly vesting for another 15 months

- Private Sale A- lock for 3 months, and then monthly vesting for another 15 months

- Private Sale B- lock for 1 month, and then monthly vesting for another 15 months

- Public Sale – 100% unlock at day 0

- Liquidity Mining on AVAX – 5% deflation per month within 48 months after Mainnet launch

- Reserve – vested based on demand

- Marketing – vested based on demand (35,000,000 unlock at day 0)

- Advisors – lock for 6 months, and then monthly vesting for another 48 months

- Team – lock for 6 months, and then monthly vesting for another 48 months

Vee Finance Roadmap

The platform hasn’t released a definitive roadmap yet. Currently, they are preparing for the launch of their mainnet. They also include new features like a multi-signature mechanism, internal testing of liquidity mining feature, and launching the UI interface of dark night mode.

The marketing team is also working hard to warm up for the main online launch, including establishing cooperation with media/community, arranging AMA, and launching joint airdrops and other activities with Vee partners.

The platform had launched its beta version on July 10 this year.

Final Thoughts

While many DeFi-based lending platforms have similar attributes, Vee Finance aims to step up the game by offering a better experience. With its foundation on Avalanche Blockchain, Vee Finance doesn’t face its other competitors’ congestion and transaction woes. Moreover, it also opens up the possibility of leveraged lending. Overall, the project has strong backing from investors, an experienced and strong team, and solid foundation.

Related Stories: