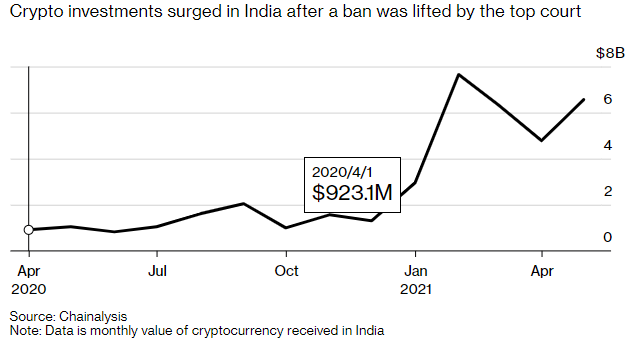

Over the past couple of years, there has been no clarity on how the Indian government looks at cryptocurrencies. From banning crypto transactions in April 2018 to lifting the ban in March 2020, and still giving mixed regulatory signals. In January this year, the government had introduced a bill to prohibit all private cryptocurrencies while planning to launch its own digital currency. What’s interesting however, is that amid all the regulatory uncertainty, Indians are pouring in billions in virtual currencies.

According to an analysis by Chainalysis, a leading crypto-analysis firm, Indians are trusting cryptocurrencies to be digital gold. With India already among the biggest holders of gold, it’s worth noting that within just the past year, investments in digital tokens have increased from a mere $200 million to $40 billion.

Why are Indians investing in crypto?

Compared to gold, which is difficult to invest in since one needs to verify the authenticity and is difficult to carry as well, one can purchase cryptocurrencies verifiably (though they need to be careful in storing it). In a report by Bloomberg, a 32-year old entrepreneur states these benefits:

“Crypto is more transparent than gold or property and returns are more in a short period of time.”

This move from gold to digital gold in the form of Bitcoin and other digital assets can be seen through other statistics too. As per World Gold Council, Indian adults below the age of 34 don’t have much investment in gold. ZebPay’s Sandeep Goenka, India’s first cryptocurrency exchange, highlighted:

“Young people find it far easier to invest in crypto than gold because the process is very simple. You go online, you can buy crypto, you don’t have to verify it, unlike gold.”

According to Coingecko, four biggest crypto exchanges in the country jumped 10x to $102 million within a year.

How many Indians have invested in crypto?

Chainalysis’s repot mentions that over 15 million Indians have invested in cryptocurrencies. The number isn’t far behind 23 million people in the US, and is much higher than 2.3 million investors in the UK. The interesting thing is that Indians are accounting for the risk of the virtual currencies getting banned because of regulatory uncertainty.

However, bigger individual investors are certainly wary of talking about their investments. That’s because, they can have retrospective tax raids. In such a case as well, investors have contingency plans such as moving their holdings to an offshore bank account.

Finishing thoughts

As we’ve pointed out before as well, cryptocurrencies are the future. Not just from the investment perspective, but also how they ensure a layer of trust for transactions, remove middlemen, and enable interesting functionality such as DeFi. So, if the Indian government bans them, they’ll be left behind in the technological as well as economic revolution. Hopefully, with the interest shown by Indian investors, the government also takes a balanced stance.