According to a Reuters report, a representative for Coinbase stated that the COIN.O options will be available for trading on Nasdaq on Tuesday, April 20th.

This comes just after Coinbase, presently the biggest cryptocurrency exchange in the U.S. is listed on Nasdaq a week ago.

The arrival of equity options will offer a new way for investors to bet on the fortunes of the company. An equity option represent the right to buy/sell a stock at a certain price known as the strike price.

Reuters estimates the the company’s CEO sold around $292 million shares on the first day of trading. Looking on the filings made with the U.S. Securities and Exchange Commission, Armstrong sold 749,999 shares in three batches. The prices for the batches ranged from $381 to $410.40 per share for a total of $291.8 million.

A report by Cointelegraph stated that insiders dumped about $5 billion in COIN stock shortly after it was listed. Filings on the Coinbase Investor Relations mentioned a total of 12,965,079 shares sold by the insiders, totaling over $4.6 billion.

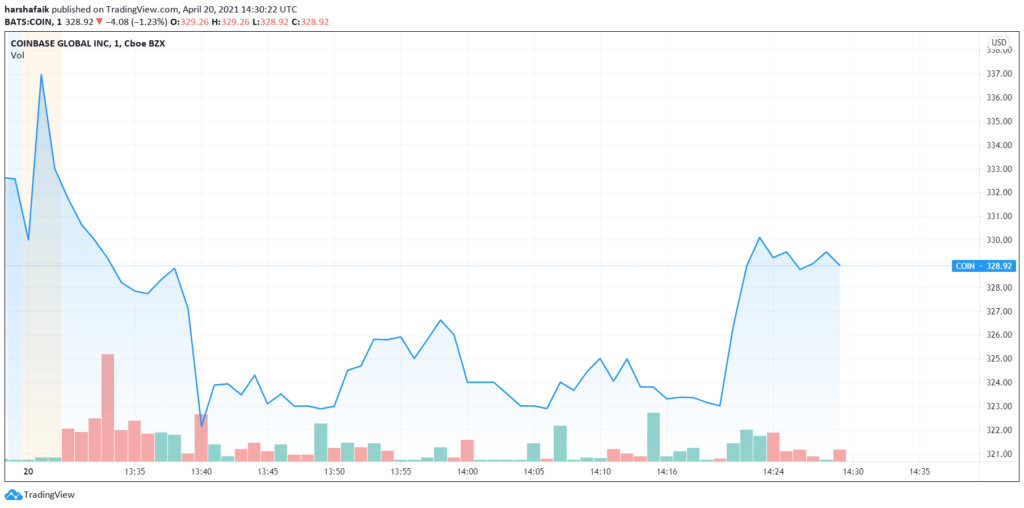

After an initial slump on April 14, COIN is rallying between mid 300s rising to a high of 340s before slumping to 320s.

Coinbase Pro has announced that will add new trading pairs for Basic Attention Token(BAT), Cardano(ADA) and USDC from April 20. The trading pairs will paired with three fiat currencies(USD, EUR, GBP) with limited trading functionality.