The Indian Government has recently released the names of 11 crypto exchanges that they’re investigating for tax evasion. According to them, they’ve recovered over $12 million from these crypto exchanges.

During a Parliament Session, S. Ramalingam, a parliament member asked the finance minister whether crypto exchanges had involvement in the evasion of GST. Besides this, the parliament member asked whether the Indian Government had taken any action against those crypto exchanges.

To this, the Ministry of State in the Ministry of Finance, Pankaj Chaudhary said:

“Few cases of evasion of goods and services tax (GST) by cryptocurrency exchanges have been detected by Central GST formations.“

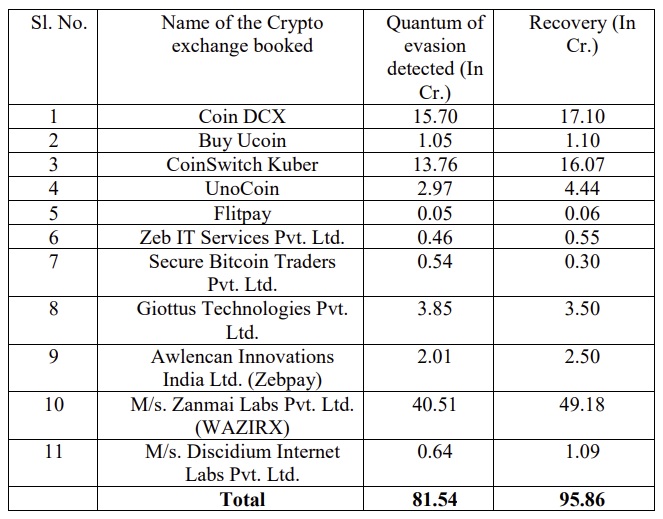

In addition to that, he revealed the names of 11 crypto exchanges from which the tax authority has recovered 95.86 crore rupees ($12.6 million).

After this, Ramalingam also asked, “whether the government has any data regarding the number of crypto exchanges involved in the crypto exchange business in the country.”

To this, Minister Chaudhary replied:

“The government does not collect any data on cryptocurrency exchanges.“

Last month, the Indian Finance Minister had announced taxation on crypto income at 30%. Besides this, the Indian government has also imposed a 1% tax deducted at source (TDS) on every crypto transaction.

While the Indian crypto community is relieved to not witness any outright ban, many believe that these could pose trouble for the emerging asset class. In fact, yesterday, A parliament member had shown concerns regarding the taxation system for the crypto transaction. Moreover, the member has urged the government to reconsider this.

Related Stories: