The DeFi infrastructure is getting considerable traction in the past few years and its no surprise that there have been a number of DApps taking advantage of the decentralized nature of finance. Here are some of the top projects to watch out for.

#1:Casper Blockchain

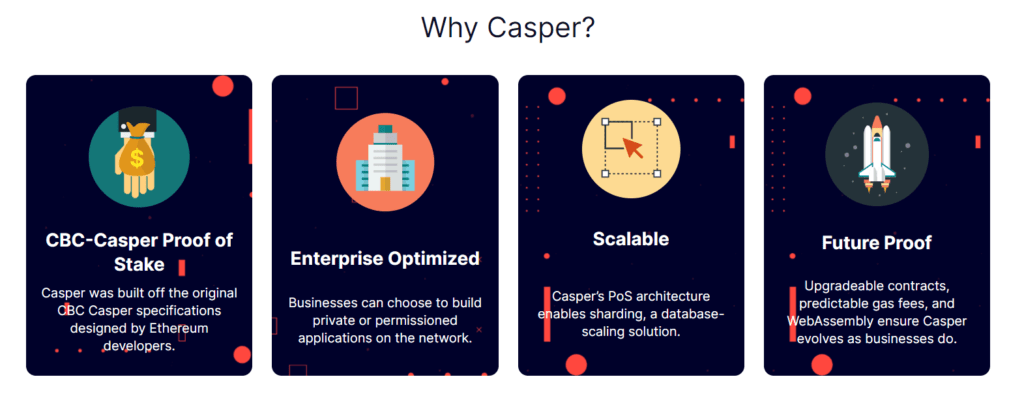

The Casper network is the first live Proof of Stake blockchain built off the Casper CBC specification designed to accelerate enterprise and developer adoption of blockchain technology today and evolve to meet user needs in the future.

Casper implementation removes the process of mining from Ethereum. Alternatively, the verification and validation of new blocks of transactions is be done by block validators, which are selected according to their stake.

Casper blockchains include a number of advantages like environment friendly-nature due to P-o-S nature and the positing of it as a selector for the ETH 2.0 ledger.

Website: casperlabs.io

#2:APYSwap

Although improved, DeFi infrastructure is riddled with issues.

- It is difficult for users to discriminate between different DeFi projects, and evaluate the potential risks & rewards of each.

- Existing DeFi instruments are too complex for the average user requiring considerable know-how.

- ETH transaction fees have grown tremendously high, making it expensive for users to interacting with other DApps.

APYSwap tries to solve this problems by simplifying yield farming and reducing costs, without sacrificing decentralization or self-custody.

It is a protocol for the decentralized exchange of shares of Tokenized Vaults. All this is achieved through a Layer 2 blockchain where users can swap accounts & assets from multiple Layer 1 blockchains.

Cryptocurrency holders can now benefit from passive income, which does not require an active portfolio management, whilst active DeFi portfolio managers can trade on behalf of the users without friction or high transaction fees.

Website: APYSwap

#3:Globe Crypto Exchange

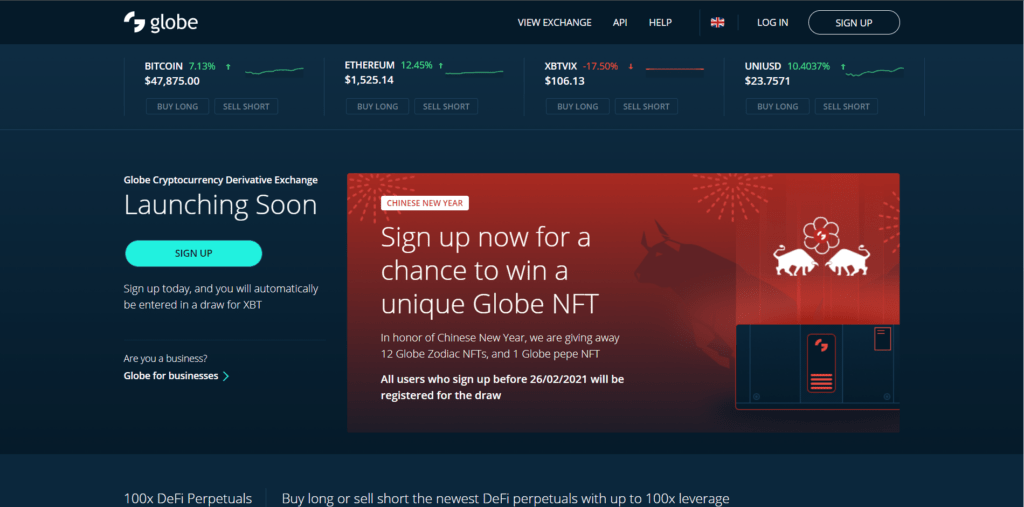

Globe is a crypto derivatives exchange where institutions and consumers transact digital currencies like bitcoin via perpetual futures contracts. Perpetual futures are a derivative product that tracks the underlying index price.

The exchange offer a number of advantages like:

- Excellent market depth – Bringing traders and institutional market makers together.

- 100x leverage – Offering up to 100X leverage for free.

- Websocket API – The purpose-built API will seamlessly integrate with your trading application with the exchange.

The exchange will soon be launched according the info available on the website.

Website: Globe (globedx.com)

#4:KeyTango

95% of crypto assets do not generate any interest and are usually idle. DeFi products could generate significant returns on these idle assets. It is not uncommon for professional DeFi traders to generate hundreds of percentage returns yearly, utilizing the most attractive opportunities in

DeFi.

KeyTango is a Web3 application made for DeFi newbies and acts as a frictionless gateway to popular DeFi products and services in a very easier manner. Unlike YFI which takes some familiarity with deep DeFi as granted, KeyTango offers an intuitive UI/UX, coupled with rich and concise content and tailored suggestions based on various parameters.

KeyTango is hoping to change the complexion of the DeFi game by giving crypto holders a new perspective in exploring the vast opportunities in the sector.

They went on beta testing a while ago (February 17th). It is to to provide an opportunity for early registrants to have a first look into the platform. A launch is expected in the first quarter of this year.

Website: KeyTango

#5:Saito

Since past few years, computer scientists have made technical strides scaling blockchain. Networks like Polkadot now offer fast confirmations, support for Para chains and layer-2 networks, enterprise-level reliability, and new features like transaction-finality. But, as the costs of running these networks have grown, fewer and fewer volunteers are providing the open access nodes needed to keep them decentralized.

Public blockchains are becoming permissioned networks dominated by one or two operators.

This is the problem that Saito solves, with an application stack that pays participants not for mining or staking, but for running user-facing infrastructure. As long as there are users for any blockchain or Para chain, there will be money to run the necessary infrastructure.

Website: Saito.io