Crypto Arbitrage Trading is a hot topic across markets. Here is a guide for you to completely understand what Crypto Arbitrage is and how you can make low-risk gains fast. Opportunities for Arbitrage are just on the rise in the crypto market. And are just offering fresh traders to make money with far less risk.

Crypto Arbitrage

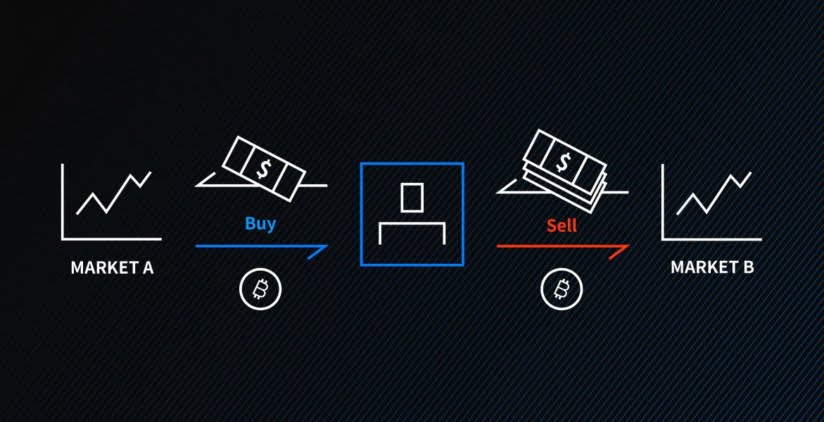

Cryptocurrency Arbitrage is a different type of trading than traditional day-trading. It is rather similar to skim trading. Arbitrage is a bit more about the bigger picture. We widen our scope from just one exchange to numerous ones. Here, investors take benefit of minute discrepancies of prices across exchanges and markets. In simpler words, the investor buys an asset on one exchange and exports it to another exchange where the price is slightly higher and sells the asset there, thereby making fractions of profit.

This type of trading has the risk level second to last; as of course, the last would be hodling. Incorporating just investing your capital in a good, well-researched coin and forgetting about it for years. Arbitrage trading is a strategy that can easily be adapted by a beginner investor also; and also requires no expensive set-up.

The Crypto market is said to be the most volatile market across other financial markets. Thus, the potential for arbitrage trading is much higher in this market. In addition, the Crypto asset prices tend to deviate over a much shorter period of time significantly. Hence, Arbitrage trading comes into the picture.

Literally, all the trader needs to do is spot a difference no matter how slight it may be and benefit from it; by making a series of transactions from one exchange to another.

Why is it ‘Low-Risk’?

In day-trading, the traders need to predict the future price of bitcoin and other coins to benefit from it. And most of the time, the trades take hours, days, or even weeks for profit generation. But in Crypto Arbitrage, traders spot opportunities, and they capitalize on them. Of course, they expect a fixed amount of profit.

This strategy also eliminates the most crucial aspect of the day-trading, also perhaps the riskiest one, technical analysis (TA). TA experts spend hours and hours studying and analyzing the market, and even after that, the risk factor does not go away. The crypto analyzed could perform according to the prediction or could just turn the tables on the traders.

Arbitrage Traders also have the luxury to enter and exit trades in seconds or minutes, if resources allow. And mind you, the requirements are nothing more than what an ordinary trader would have.

Types of Arbitrage

- Triangular Arbitrage: This is a bit complicated strategy and it involves trading across exchanges and also across trading pairs. It does pose the risk of asset spillage. Spillage is the price difference when you decide to enter a trade and when your trade actually goes through. Triangular Arbitrage poses higher spillage risks as the trader is trading in more than one pair of assets.

- Spatial Arbitrage: This type of arbitrage trading could be classified as the easiest. It involves in buying an asset on one exchange and selling it on the other; both the processes happening immediately.

- Convergence Trading: This would lie between the other two types. It also involves the trader buying an asset on one exchange. The key difference would be to see both of the prices converge, hence the name Convergence Trading.

Takeaway

Surely Crypto Arbitrage is quite the rage right now. But like any trading, do your research. And have a good grip over what you have in your portfolio. The ‘slower’ nature of the asset matters in Arbitrage. Perhaps the passive trend of the coin might not affect this strategy much. But the crown of “the most volatile market” is on the Crypto market’s head for a reason. So the unpredictability of the market is still something to consider.

And it goes without saying that one should never enter a trade without having proper knowledge of what the asset is and what influences the price of that asset; may it be bitcoin, oil, or forex, or even gold. So in conclusion, Do your own research; Always complete the due diligence, and Happy Trading.