UXD Protocol is a crypto native stablecoin backed by a delta neutral position using derivatives. What does this mean? And how would this help the crypto space? Is this a new revolution in the industry?

Stablecoins enable investors to keep money in their digital wallets that are less volatile than bitcoin, giving them one less reason to need a bank account. For a whole movement about a declaration of independence from banks and other centralized financial providers, stablecoins help facilitate that.

What is UXD?

A wide range of stablecoins circulating in the crypto ecosystem, such as Tether, USD Coin, Paxos Standard, Dai, etc. But fiat-backed stablecoins suffer from censorship and audit problems. Cryptocurrency-backed stablecoins are capital inefficient and can be unstable during extreme market volatility. Algorithmic stablecoins are susceptible to a collapse in confidence by holders of the stablecoin and are at risk of bank runs.

UXD Protocol is a decentralized stablecoin protocol built on Solana. It was founded in 2020 as Soteria and more recently, rebranded to UXD. The protocol is currently being built — the devnet app was launched on October 4th. And the main net launch is expected in November.

UXD Protocol proposes solving these problems by eliminating the need to convert to fiat currencies and be stable

under any market volatility. UXD Protocol is also more capital efficient than cryptocurrency-backed alternatives since UXD Protocol does not require an excess of funds to back the stablecoin.

UXD is the native stablecoin of the protocol, pegged to $1USD.

UXP is the protocol’s governance token, which controls the UXD DAO.

The UXD Working Mechanism

The stablecoin is pegged to fiat currencies by connecting to a derivatives dex. Users earn interest generated from the funding rate. Also, Arbitrage ensures that the price of stablecoins does not deviate from the price of fiat currencies. Any user will be able to issue and redeem the stablecoins for a decentralized cryptocurrency at par value.

Since the collateral backing, the stablecoin, is not held by a centralized third party, the collateral is not at risk of being seized by a hostile third party. The stablecoin will have the censorship-resistant properties of cryptocurrency and the price stability of fiat currencies. The funding rate results in yield to the holders of the stablecoin,

which makes stablecoin an attractive store of value.

The protocol holds a collateral asset (like SOL or BTC) and simultaneously shorts the same asset via a futures contract. It holds a long position and a corresponding short position on the same asset, meaning it has no exposure to the asset’s price movements. This type of position is called delta neutral and is stable in dollar terms, regardless of the asset’s price movement. This position is then tokenized to create a stable crypto-dollar.

The Flow of Funds

- The user deposits BTC worth 100 USD to the vault of UXD Protocol.

- UXD Protocol will mint 100 stablecoins (100 UXD). Total USD value of BTC deposited by the user = amount of UXD issued to the user.

- Users can transact with UXD. The user can transfer, exchange, and store UXD.

- UXD Protocol transfers the BTC to a derivative dex and creates a delta neutral position to hedge.

- The user deposits 100 UXD to the UXD Protocol vault for redemption into 100 USD worth of BTC.

- The delta neutral position is unwinded at the derivative dex and the BTC is withdrawn to the UXD Protocol vault.

- UXD Protocol will destroy the UXD and an equivalent amount of BTC will be withdrawn to the user’s wallet.

Users will also be able to obtain UXD through centralized and decentralized exchanges and other third-party services. Once the UXD is in circulation, it is freely traded.

How is it Better?

There are some key advantages that UXD has relative to other stablecoin protocols.

Decentralized

While centralized stablecoins like Tether and USDC have seen impressive growth, they’re completely different from decentralized stablecoins like UXD. Centralized stablecoins carry a very high regulatory risk — new legislation could result in them being banned, whitelisted, or having other changes that drastically affect their utility. And if major regulatory action is taken against a centralized stablecoin provider, it will serve as a positive catalyst for adopting decentralized alternatives like UXD.

UXD exists entirely on-chain and doesn’t require intermediaries. It’s censorship-resistant, verifiable, auditable, and has no single point of failure. Also, truly decentralized finance is only possible with decentralized stablecoins, and these tokens will continue to grow in importance over time. Thus, it upholds the true spirit of DeFi.

Other decentralized stablecoins like Maker, FRAX, and others are primarily backed by centralized assets like USDC. Thus this increases their attack surface and makes them less genuinely decentralized.

Capital Efficient

Because UXD doesn’t rely on over-collateralization, it’s more capital efficient than comparable decentralized stablecoins like Maker.

$100 of SOL or BTC deposited into the UXD Protocol creates exactly 100 UXD. This is comparable to centralized systems like USDC, where tokens are backed 1:1 with collateral. Systems like Maker can only issue stablecoins for a portion of the deposited collateral value. This creates inefficiencies and barriers to scale.

In many ways, UXD combines the best of both worlds. It’s as capital efficient as the most successful centralized stablecoins on the market (USDC, Tether) and robust in the most successful decentralized stablecoin (Maker). It also avoids the inherent risks of unbacked or partially backed “algorithmic” stablecoins that don’t utilize collateral.

Resilient Stability

Most stablecoin protocols rely on collateral assets to back the value of the stablecoin. Many of them require over-collateralization to protect against large price movements in the underlying collateral. Therefore, If the collateral value moves too much too quickly, the stablecoin can become under-collateralized and lose its peg. Others rely on “algorithmic” stability prone to bank runs, attacks, and loss-of-confidence death spirals. Unfortunately, a purely algorithmic (i.e. unbacked) stablecoin does not currently exist and may never materialize.

Collateral assets don’t actually back UXD in a vault contract. Instead, it is claimed that it’s backed by an auditable on-chain delta neutral position that is designed to maintain a stable value even in the case of price swings in the underlying asset. I believe this to be a more robust stability mechanism than anything that currently exists on the market.

The Token Economy

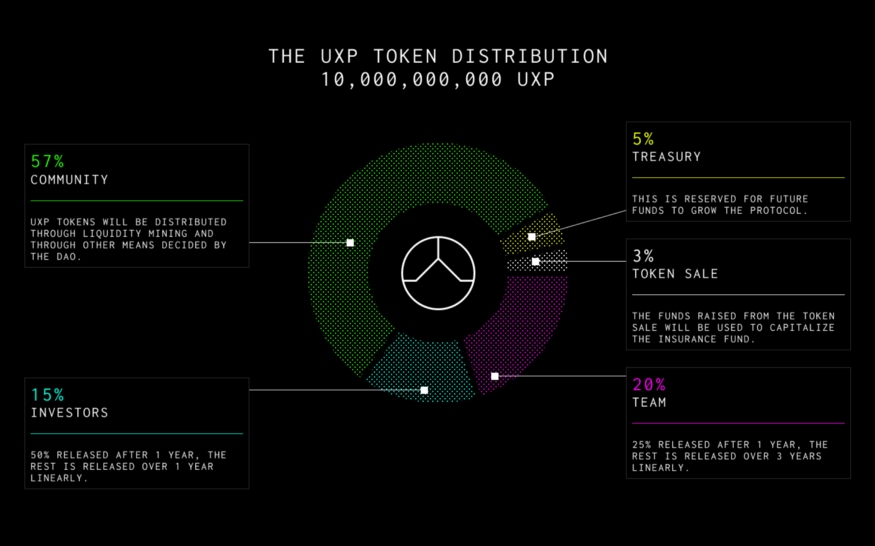

The UXP token is the native governance token for the UXD Protocol.

The UXP token also serves the important role of providing a reserve of last resort for the protocol’s insurance fund. If the insurance fund is ever depleted, so the protocol will automatically mint new UXP tokens and auction them off to restock the insurance fund. UXP holders assume this risk.

What else is different?

First of Its Kind

UXD is the first-ever stablecoin backed by an on-chain delta neutral position. This is a much-needed innovation for stablecoins and one that is uniquely enabled by Solana’s scalable architecture and existing DEX infrastructure.

First to Market on Solana

Solana is the first smart contract platform to challenge Ethereum legitimately, and the ecosystem is developing at an impressive pace. In addition, a number of centralized stablecoins are available on Solana. And Ethereum-native stablecoins can be bridged overusing Wormhole.

The Risks

With all the good stuff, there sure are some risks to consider.

Smart Contract / Protocol Risk

UXD Protocol is currently under construction. All new protocols and contracts carry some inherent risk. Bugs or exploits in the contracts of either UXD or Mango Markets (and other integrated DEXs) are always a possibility that needs to be considered.

Furthermore, the community should encourage formal audits and measured growth to help prevent these possibilities from becoming existential threats.

Market Risk

Some rare but possible market conditions could result in UXD positions losing value such that UXD tokens become un-backed.

Token Sale

IDO is already out and you can check it out on The UXD Token Sale Website. The protocol has raised 57,086,131.8292 USDC (USD Coin pegged to the United States Dollar) so far and is gaining traction quickly.

The Investors

The Takeaway

Competition among stablecoins is fierce, and there’s a massive advantage to being the first to market. And because Solana is such a growing ecosystem, there’s a huge opportunity for UXD to be the decentralized stablecoin of Solana and to benefit from the enormous growth the ecosystem will likely have over the next few years.

However, there are no Solana-native decentralized stablecoins, and UXD will likely be the first to market. As a result, people who are excluded from the banking system will now store and transact in a stable currency without censorship.

So how does one make money off UXD. If I convert SOL to UXD, I just get a $1 stablecoin that doesn’t move…

Do you receive dividends in UXD? UXP? How do you benefit from locking up assets and getting UXD?

These articles are very confusing for novice users. They make far too many assumptions that people just know how all this works. Only way this ecosystem grows is through new users, but most folks are just turned off because it’s too hard to understand.

I’m sure it’s supposed to be ambiguous…