NFT ranks high among the most interesting developments happening in the cryptocurrency and blockchain space. By assigning a unique value to each and every collectable, not only non fungible tokens give them a utility, but they also ensure that the collector can prove their value with authenticity. But having a marketplace like OpenSea or games like CryptoKitties barely scratches the surface as to what NFT can enable.

Read: The NFT market opportunity

One such project that’s aiming to take NFTs to the next level is NFTfi. In simple terms, it lets you lend or borrow against NFTs. NFTfi recently launched a promissory note, which is full of exciting possibilities, but before we discuss that. Let’s first get to know…

What is NFTfi?

One of the biggest differences between traditional markets and cryptocurrency markets is the ability for anyone to borrow against a collateral. Things of course are changing with DeFi (decentralised finance) which lets you put up your crypto assets and borrow some money or vice versa. But what if you own a lot of NFTs, be in the form of assets earned through games, or a digital artwork that you have acquired?

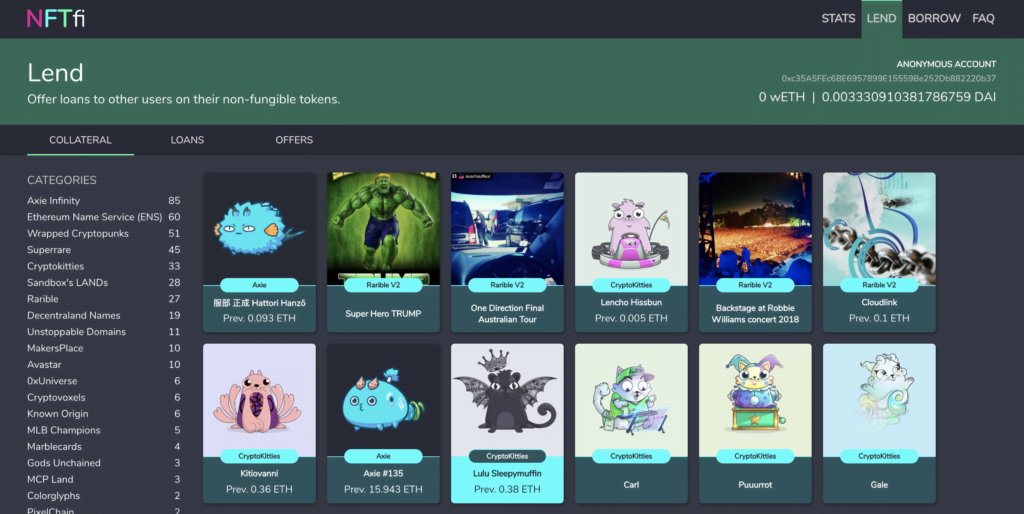

That’s where NFTfi enters the picture. It’s a marketplace which connects lenders and borrowers to let the latter put up their NFT assets as a collateral and borrow money.

How NFTfi works?

Think of NFTfi as a P2P marketplace. What that means is that NFTfi acts as a platform that brings both borrowers and lenders at one place, but then it doesn’t play any active role. Lenders can make offer to the borrowers for their NFT assets along with the duration (7, 30, or 90 days), and borrowers can choose to accept or reject the offer.

Wondering how NFTfi makes profits? Well, it only makes in case the borrower returns the money along with the interest. In such as case, NFTfi will take 5% of the interest as a fee. If no fees are paid because of the loan’s foreclosure, then NFTfi won’t take any fees.

What is NFTfi Promissory Note

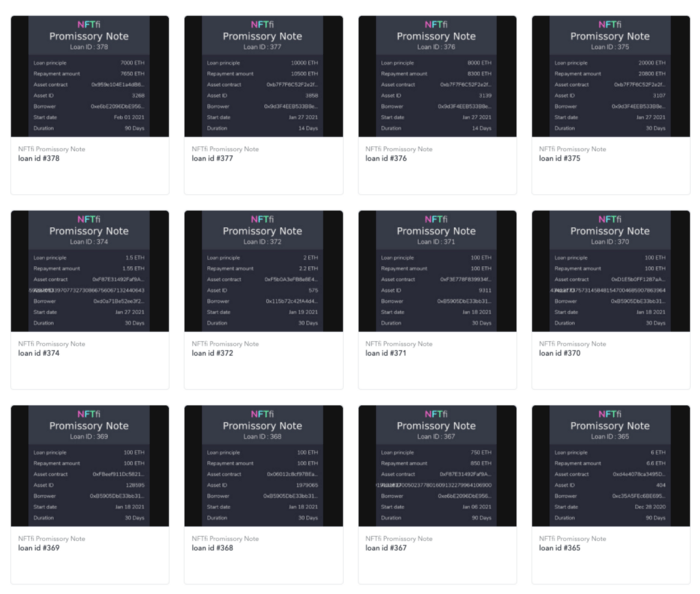

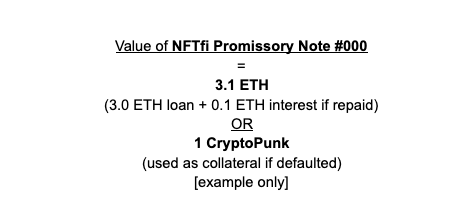

Now that we’ve understood how NFTfi platform works, we can talk about promissory Note. In traditional world, promissory note is a legal note about the fact that the borrower will be repaying the specified amount after a certain period. The NFTfi promissory note isn’t much different from that, and it does add another clause about the lender receiving the NFT in case of the foreclosure of the loan.

Technically, a promissory note is an ERC721 token, i.e. an NFT itself. The lender will always receive a promissory note. In case, the NFTfi smart contract recognizes that the loan term is over, and the borrower hasn’t returned the loan + interest, NFTfi panel will now give the lender the option to receive the NFT as a collateral.

Thus, promissory note ensures that the borrower never gets cheated. Either they’ll receive the money (along with interest) or the NFT against which they lend the money.

What are the possibilities with NFTfi Promissory Note?

While the promissory note is quite interesting, the real benefit comes when you consider that it’s an NFT itself. If you, as a borrower, need money, then you can sell the promissory note. In fact, you could possibly get a profit as well if the NFT against which you lent the money has increased in value. Since this an asset as well, one can take a loan against it as well.

Finishing thoughts

One of the biggest problems with the collectible space is liquidity. With NFTfi, that’s being solved, and the promissory note ensures that the liquidity that’s being provided in the marketplace doesn’t result in any losses for the lender. As a matter of fact, a lender doesn’t have to lose anything for they’ll either receive the loan + interest or the NFT as per the terms of the loan.