Out of all the enforcement actions related to crypto in the United States of America, the largest one was against the popular text messaging app Telegram Group’s wholly-owned subsidiary Ton Issuer Inc.

U.S. Securities and Exchange Commission (SEC) imposed the action against the firm, alleging that Telegram’s tokens or ‘grams’ as they called it were unregistered securities offering. In conclusion, the defendants agreed to return more than $1.2 billion to investors and pay an $18.5 million civil penalty, per a report by Blockchain analytics firm Elliptic.

Elliptic had released a report earlier this week outlining “crypto enforcement actions by U.S regulators.” The report dismissed the popular myth that the “crypto-asset industry is unregulated as US regulators are increasingly imposing significant financial penalties on crypto businesses.”

“Our analysis of crypto asset-related enforcement actions in the US demonstrates that crypto is far from being the ‘wild west of finance. Regulators have successfully used existing laws to halt and penalize illicit activity that has exploited crypto assets.”

Elliptic

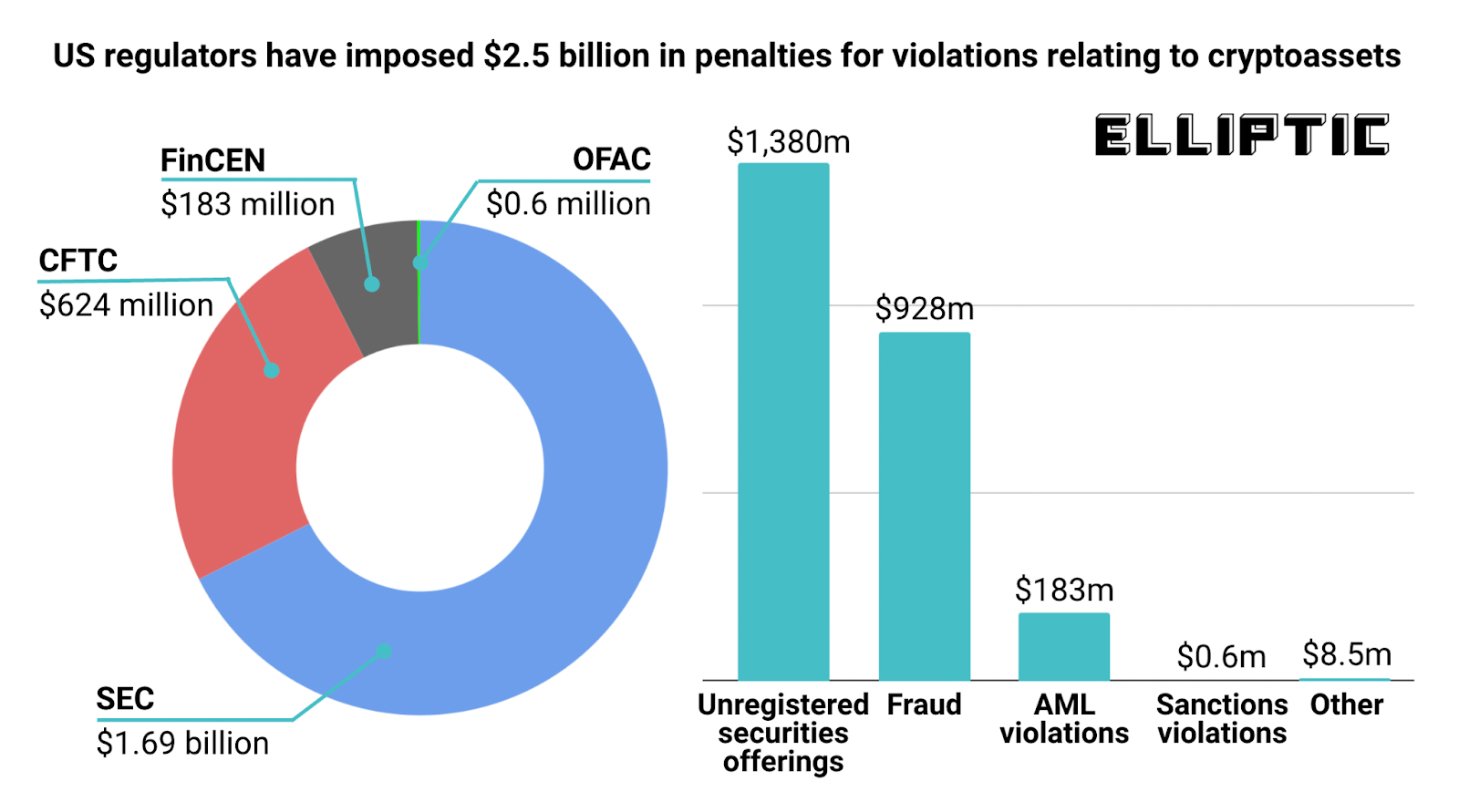

The firm has analyzed enforcement actions by U.S regulators since the origin of Bitcoin in 2009 and concluded that “$2.5 billion in penalties have been imposed against firms and individuals dealing in crypto.”

Out of all the agencies that have imposed crypto-related penalties, the SEC comes out on top with $1.69 billion. As far as the nature of the penalty goes, $1.38 billion was found under unregistered securities offerings.

The commodity futures trading commission came second with enforcement actions totalling $624 million. Following that comes Financial Crimes Enforcement Network with $183 million.

Related Stories: