The rise of Uniswap and other decentralized exchanges has made it clear that DeFi is here to stay. More importantly, it’s evident that users would ideally want to rely on DEXs to trade upon decentralized cryptocurrencies rather than centralized exchanges. However, DEXs have their own set of challenges. For example, Uniswap only allows you to trade Ethereum-based virtual currencies, while Binance Smart Chain can let you trade assets based on its chain. What if there could be a DEX that will let one trade cross-chain? Enter Vegaswap, a global DeFi marketplace supporting cross-chain transactions. The project has launched recently, and here’s what you need to know about it.

Overview

Vegaswap can be best defined as an automated market maker (AMM) protocol with multi-chain support. It also offers a slew of DeFi applications, including a marketplace. The marketplace is for swapping any blockchain-based assets.

For the marketplace, Vegaswap uses a concept called options greeks, a popular concept for derivatives for the structure of market and marking making. There are several option greeks like Delta, Theta, Gamma, and Vega.

Vega (v) is the derivative of the option value with respect to the volatility of the underlying asset. Hence, the name of the project is Vegaswap.

Team and advisors

While the Vegaswap team details haven’t been divulged by the project, it has mentioned its advisors. These include:

- Kyle Chasse (CEO, Master Ventures and PAID Network)

- Dane Hoy (Managing Partner, Master Ventures and PAID Network)

- Dr Deeban Ratneswaran (CEO, GD10 Ventures)

- Roderick McKinley (CFA, Independ Advisor)

Backers

Vegaswap is being incubated by Master Ventures as part of its FUEL program.

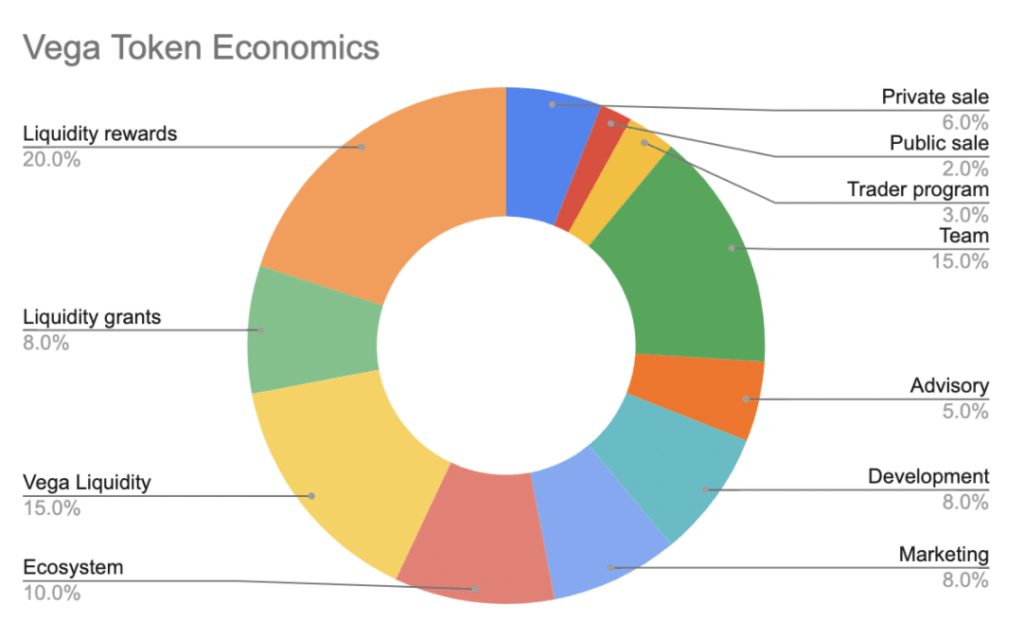

Tokenomics

As with most platforms, Vegaswap has a utility token. Dubbed vega, it is used for the governance of the platform. As per the whitepaper, the tokenomics are designed in such a manner that there’s an equitable distribution between investors, participants, and liquidity providers, as shown in the image below.

Use case

Vegaswap combines AMM protocol with the MM pool (a market-making fund that acts like a hedge fund). This ensures that there’s flexibility in the pricing mechanism with an equal basis accounting. This allows liquidity providers to earn fees on a percentage basis.

Compared to Uniswap, the fees is calculated dynamically. The fees are paid from the market takers (people taking directional positions) to liquidity providers.

Another goal of the Vegaswap protocol is that it aims to reduce the loss from arbitrage. It does so to maximize the potential for the owners of the pool and Vega token holders.

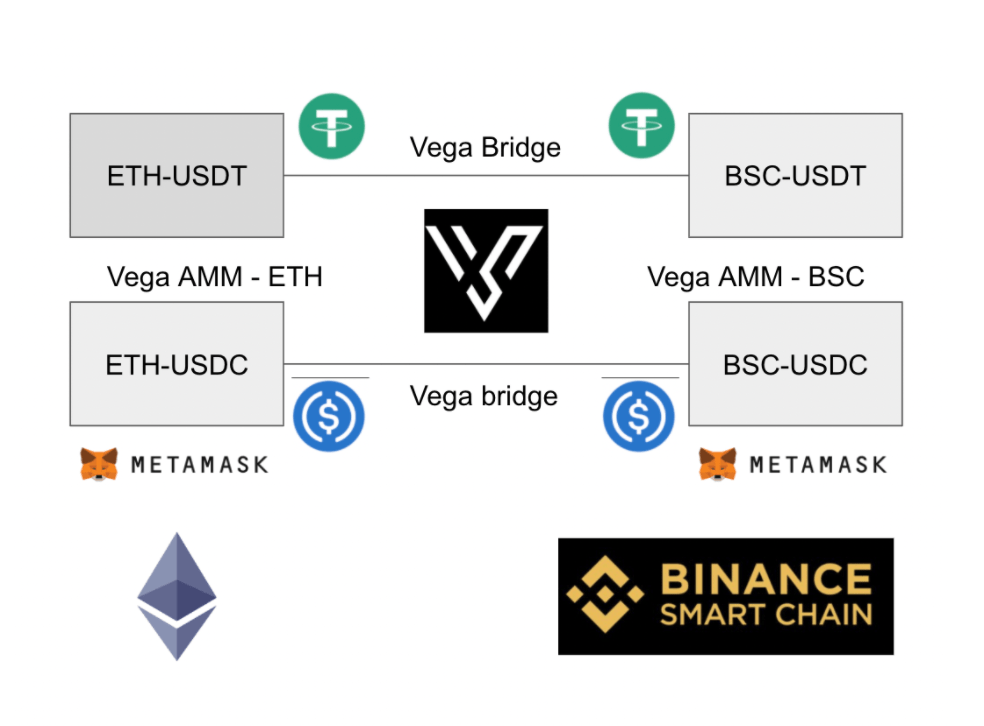

The biggest feature of Vegaswap is multi-chain AMM allowing it to enable cross-chain transactions in a decentralized manner (since currently, this is possible in a centralized exchange only).

Roadmap

In the current quarter, the protocol will be launching on Uniswap. It’ll also launch smart pool technology and trader incentive program, among other things.

In the next quarter, it’ll be launching BasePool, multi-chain bridge, MM analytics, and more. In Q4 2021, it’ll be launching marketplace functionality, proof of liquidity, MM toolbox, etc.

For Q1 2022, the project will be introducing Oracle and CEX integrations, Chrome extension to support multi-chain transactions.

Conclusion

Vegaswap has many moving parts, but all of them aim to bring decentralization to multi-chain transactions. And that’s what makes it stand out from other decentralized exchanges such as Uniswap and PancakeSwap.