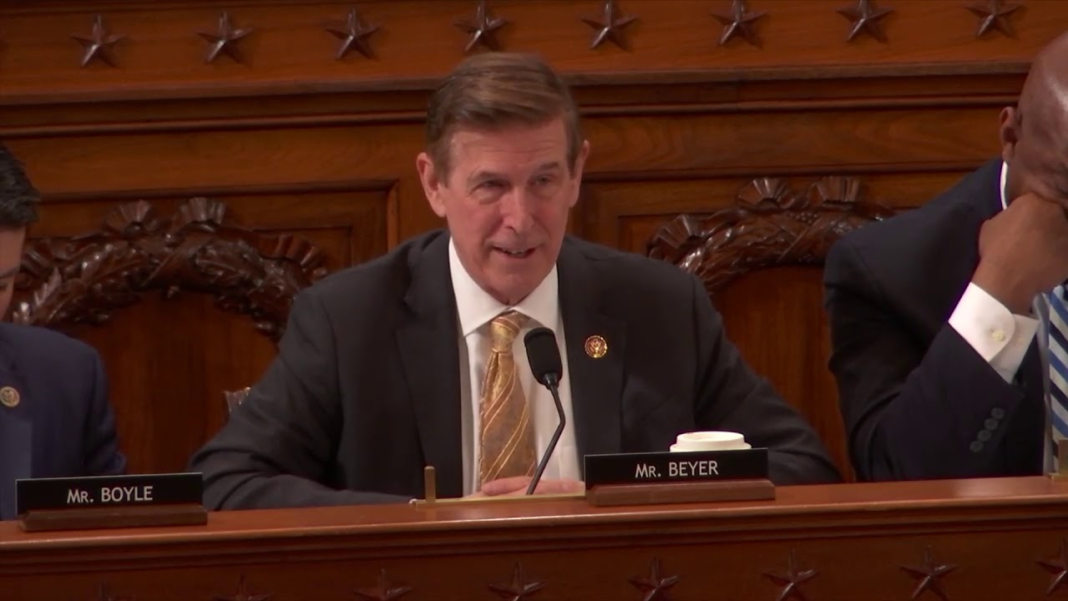

Representative Don Beyer is the chairman of the U.S. Congress Joint Economic Committee who has introduced the legislation to provide a “comprehensive legal framework” to the crypto market. Through this, the federal government gets the ability to extensively regulate the crypto market. Moreover, it can even ban some private cryptocurrencies or stablecoins if deemed unfit.

According to the representative, the existing crypto market structure and regulations are too “ambiguous and dangerous for investors and consumers.”

Some of the provisions in the legislation are:

- Creation of statutory definitions for digital assets and respective securities. Also, providing the Securities and Exchange Commission (SEC) with authority over digital asset securities.

- Mandatory reporting of digital asset transactions which not recorded on the distributed ledger within 24 hours. In doing so, there is minimal potential for fraud and promotion of transparency.

- Addition of digital assets and respective securities to the statutory definition of “monetary instruments,” under the Bank Secrecy Act (BSA).

- Federal reserve gets the explicit authority of issuing digital version of the U.S dollar. Also, clarification that digital asset securities and fiat-based stablecoins are not U.S. legal tender, and provide the U.S. Treasury Secretary with authority to permit or prohibit US dollar and other fiat-based stablecoins.

- Finally, Federal Deposit Insurance Corporation (FDIC), National Credit Union Administration (NCUA), and Securities Investor Protection Corporation (SIPC) will issue consumer advisories on “non coverage” of digital assets or digital asset securities. This is to ensure that consumers are aware that they are not insured or protected in the same way as bank deposits or securities.

According to the representative, there are 11,000+ digital asset tokens with a market cap of over $1.5 trillion.

Related Stories: